Back

2 Mar 2020

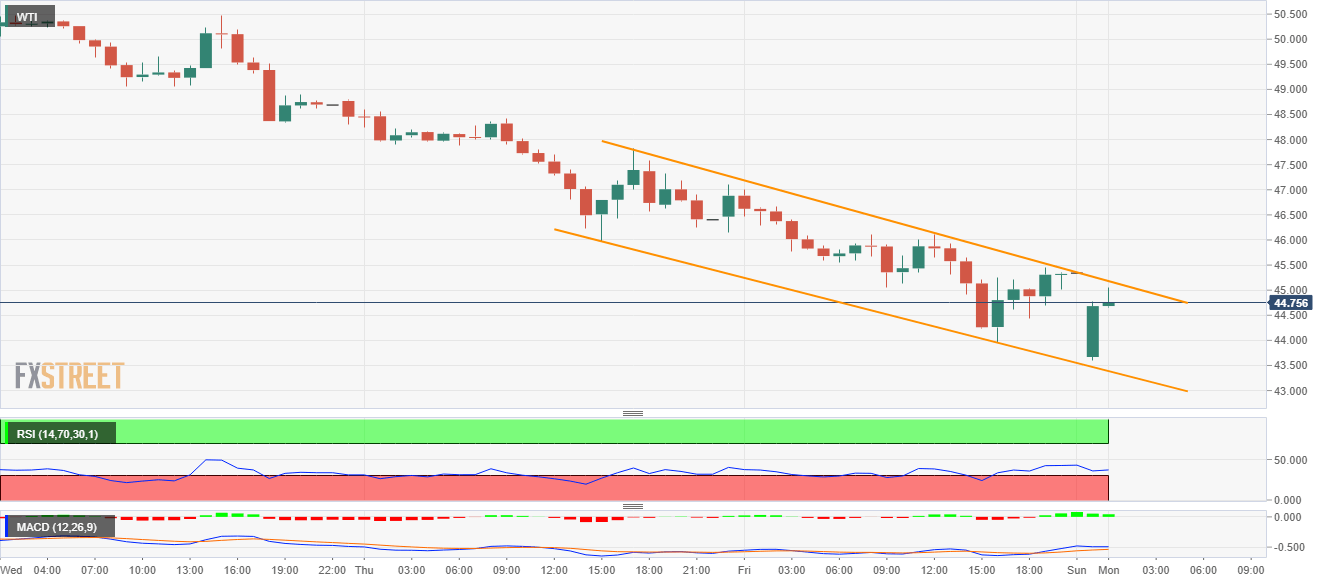

WTI Price Analysis: Focus on short-term falling trend channel on H1

- WTI bounces off short-term falling trend channel’s support.

- Buyers will look for a sustained break of the channel’s resistance to extend the recovery.

- December 2018 low will grab the bears’ attention during the further declines.

WTI extends the pullback from multi-month low to $44.85 during the Asian session on Monday. Even so, the energy benchmark stays inside a short-term falling trend channel on the one-hour (H1) chart.

As a result, buyers will look for entry following a successful break of $45.20 to stretched the bounces towards $46.00 and Friday’s high surrounding $47.10.

Should there be a further upside past-$47.10, $50.00 will be on the bulls’ radars to watch.

Alternatively, $44.00 and the said channel’s support, around $43.40, can act as immediate rest-points during the quote’s fresh declines.

However, the black gold’s further downside below $43.40 will be vulnerable to recall December 2018 low near $42.15 on the chart.

WTI hourly chart

Trend: Bearish