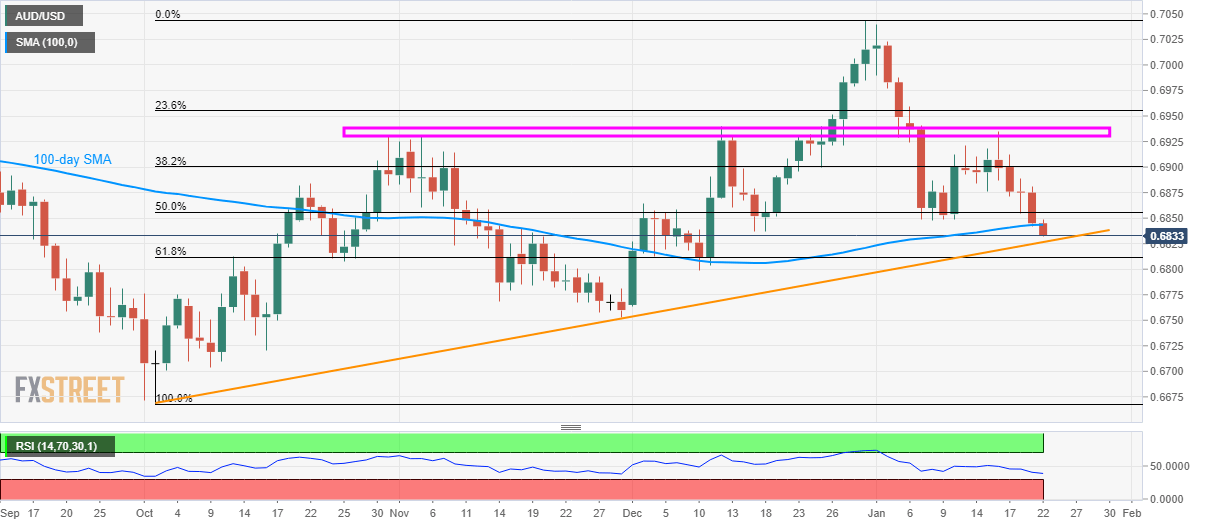

AUD/USD Price Analysis: Nears six-week low of 0.6835 on the break of 100-day SMA

- AUD/USD closes below 50% of Fibonacci retracement for the time in a month.

- An ascending trend line since early-October, 61.8% of Fibonacci retracement will question sellers.

- 0.6930/40 area limit pair’s near-term upside.

AUD/USD extends its four-day-old declines while flashing fresh six-week low of 0.6835 during early Wednesday. The pair registered its first daily closing below 100-day SMA since early December on Tuesday.

With this, the Aussie prices are likely to slip further towards a 16-week-old rising trend line, at 0.6827, whereas 61.8% Fibonacci retracement of the pair’s October-December month upside, near 0.6812, will restrict extended downside.

If at all bears refrain from respecting the key Fibonacci retracement level, the November month low surrounding 0.6750 could grab the spotlight.

Alternatively, 50% and 38.2% of Fibonacci retracement levels, near 0.6855 and 0.6900 respectively, will question the pair’s pullback moves ahead of 0.6930/40 area including multiple tops marked since October-end.

In a case where the bulls dominate beyond 0.6940, 0.7000 and the previous month top around 0.7045 will return to the charts.

AUD/USD daily chart

Trend: Bearish